REFERENCE: Ref.10_05

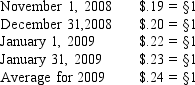

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-When preparing a consolidating statement of cash flows,which of the following statements is false?

Definitions:

Q2: Total unsecured liabilities are calculated to be

Q4: Which of the following is not a

Q12: What are the two groups of financial

Q37: Julius is a single taxpayer. During

Q37: The Abrams,Bartle,and Creighton partnership began the process

Q42: What was Nolan's share of income for

Q71: Filing status<br>A)Unmarried without dependents.<br>B)Generally used when financial

Q85: Linda's personal records for the current

Q128: Carey and Corrine are married and have

Q146: Carlos had $3,950 of state taxes withheld