REFERENCE: Ref.10_12

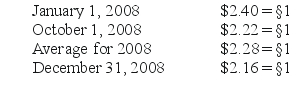

Ginvold Co.began operating a subsidiary in a foreign country on January 1,2008 by acquiring all of the common stock for §50,000.This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1,2008.A building was then purchased for §170,000.This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method.The building was immediately rented for three years to a group of local doctors for §6,000 per month.By year-end,payments totaling §60,000 had been made.On October 1,§5,000 were paid for a repair made on that date.A cash dividend of §6,000 was transferred back to Ginvold on December 31,2008.The functional currency for the subsidiary was the stickle.Currency exchange rates were as follows:

SHAPE \* MERGEFORMAT

-Prepare a statement of retained earnings for this subsidiary in stickles and then translate these amounts into U.S.dollars.

Definitions:

Radiation Type

Describes the various forms of energy emitted from a source, such as alpha, beta, gamma rays, and X-rays.

Decay Particles

The smaller particles or energy emitted from a nucleus during radioactive decay.

Half-life

The time required for a quantity to reduce to half its initial value, commonly used in nuclear physics to describe the decay of radioactive substances.

Alpha Particle

A type of radioactive emission consisting of two protons and two neutrons, equivalent to a helium nucleus.

Q17: What is shelf registration?<br>A)a procedure that allows

Q20: What is the balance in the Investment

Q21: Determine the balance in both capital accounts

Q57: Eden contributes $49,000 into the partnership for

Q70: Assume the functional currency is the U.S.dollar,compute

Q72: Louise makes the following contributions during

Q75: Self-employed sports agent pays $6,000 of self-employment

Q90: Nanci purchases all of the assets

Q104: On Deuce's December 31,2008 balance sheet,what balance

Q160: To recognize such basic personal living costs