REFERENCE: Ref.10_12

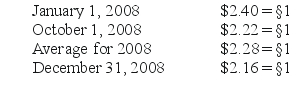

Ginvold Co.began operating a subsidiary in a foreign country on January 1,2008 by acquiring all of the common stock for §50,000.This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1,2008.A building was then purchased for §170,000.This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method.The building was immediately rented for three years to a group of local doctors for §6,000 per month.By year-end,payments totaling §60,000 had been made.On October 1,§5,000 were paid for a repair made on that date.A cash dividend of §6,000 was transferred back to Ginvold on December 31,2008.The functional currency for the subsidiary was the stickle.Currency exchange rates were as follows:

SHAPE \* MERGEFORMAT

-Prepare a statement of cash flows for this subsidiary in stickles and then translate these amounts into U.S.dollars.

Definitions:

Exercise Price

The specified price at which the holder of an option can buy (in the case of a call option) or sell (in the case of a put option) the underlying security or commodity.

Option Price

The cost at which an option's holder has the right to purchase (for a call option) or sell (for a put option) the underlying asset or commodity.

Market Value

The present rate at which a service or asset is available for purchase or sale in the market.

Equity

The value of an asset after deducting the amount of all liabilities on that asset. In investing, it often refers to the ownership interest held by shareholders in a corporation.

Q8: What problems are caused by diverse accounting

Q14: A city enacted a special tax levy

Q15: Assume the functional currency is the U.S.dollar,compute

Q18: What is the balance of Donald's capital

Q31: The Abrams,Bartle,and Creighton partnership began the process

Q43: On June 10, 2017, Akira receives a

Q67: What are the four interconnected goals that

Q78: Reiko buys 200 shares of Saratoga Corporation

Q81: What is the primary objective of the

Q94: Assuming the functional currency of the subsidiary