REFERENCE: Ref.10_13

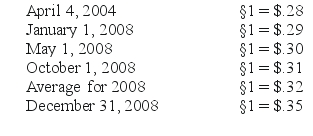

Boerkian Co.started 2008 with two assets: cash of §26,000 (stickles)and land that originally cost §72,000 when acquired on April 4,2004.On May 1,2008,the company rendered services to a customer for §36,000,an amount immediately paid in cash.On October 1,2008,the company incurred an operating expense of §22,000 that was immediately paid.No other transactions occurred during the year.Currency exchange rates were as follows:

SHAPE \* MERGEFORMAT

-Assume (1)that Boerkian was a foreign subsidiary of a U.S.multinational company that used the U.S.dollar as its functional currency and (2)that the stickle was the functional currency of the subsidiary.What was the translation adjustment for this subsidiary for 2008?

Definitions:

Information Richness

The capacity of information to change understanding within a time interval, highlighting the value of comprehensive and detailed communication.

E-Commerce

The buying and selling of goods and services over the internet.

Reflective Listening

A communication strategy where the listener repeats back what is said to them, demonstrating understanding and validating the speaker’s message.

Interpersonal Communication

The transfer of information, emotions, and meanings among two or more individuals using either spoken or unspoken techniques.

Q6: Which statement is false regarding the Sarbanes-Oxley

Q19: What was the balance in the Investment

Q19: During the year, Daniel sells both of

Q21: Property taxes of 1,500,000 are levied for

Q28: Brown and Green are forming a business

Q58: For a foreign subsidiary that uses the

Q59: Which of the following statements is true

Q64: Jarmon Company owns twenty-three percent of the

Q71: The balance in the investment in Sacco

Q117: The balance in the investment account at