REFERENCE: Ref.10_05

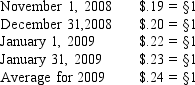

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

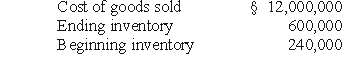

-A U.S.company's foreign subsidiary had the following amounts in stickles (§) in 2009:

The average exchange rate during 2009 was §1 = $.96.The beginning inventory was acquired when the exchange rate was §1 = $1.20.The ending inventory was acquired when the exchange rate was §1 = $.90.The exchange rate at December 31,2009 was §1 = $.84.Assuming that the foreign country had a highly inflationary economy,at what amount should the foreign subsidiary's cost of goods sold have been reflected in the 2009 U.S.dollar income statement?

Definitions:

Participant Race

Refers to the racial background of individuals taking part in a study, which can influence outcomes and interpretations, highlighting the need for diversity in research samples.

Google Slides

A web-based presentation program included in the Google Drive service allowing users to create, edit, and present slideshows online.

PowerPoint

A presentation program developed by Microsoft, used to create visual aids for presentations by combining text, graphics, and multimedia.

Slideware

Generic term for presentation software such as PowerPoint and Keynote.

Q14: Which of the following taxes is deductible

Q17: Prepare the journal entry for Donald,Chief &

Q28: How should the fresh start reorganization value

Q37: What journal entry will be recorded in

Q38: Under the current rate method,retained earnings would

Q47: Determine the cash to be retained and

Q50: Regulation S-K<br>A)controls the listing of securities by

Q72: Taxpayers who construct property for their own

Q103: Tower Inc.owns 30% of Yale Co.and applies

Q163: Certain interest expense can be carried forward