REFERENCE: Ref.10_05

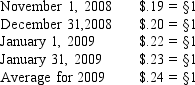

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-Under the current rate method,inventory at market would be restated at what rate?

Definitions:

Terrestrial Radiation

The naturally occurring radiation from radioactive materials in the soil, rocks, and atmosphere.

Earth's Crust

Earth's crust is the outermost layer of the Earth, consisting of rocks and minerals, and constituting less than 1% of Earth's volume.

Radioactive Materials

Substances that emit radiation due to the spontaneous breakdown of atomic nuclei, used in energy production, medicine, and industry.

Cosmic Radiation

High-energy particles, primarily originating from outside the solar system, that travel through space and can affect Earth and spacecraft.

Q4: Which of the following is not a

Q26: What assets would be included in the

Q55: What was the balance in the investment

Q55: What is normally required before a reorganization

Q68: Compute ending inventory for 2009 under the

Q72: When translating Quadros' financial statements,which of the

Q72: For a government,what kind of operations are

Q94: Bowden is a single individual and

Q95: If the executor of a decedent's estate

Q107: Kristin has AGI of $120,000 in 2018