REFERENCE: Ref.10_05

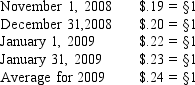

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-Under the temporal method,common stock would be restated at what rate?

Definitions:

Q4: When a city holds pension monies for

Q14: Which method of translating a foreign subsidiary's

Q15: Prepare the journal entries for the dissolution

Q16: Total unsecured liabilities are calculated to be

Q38: Eden acquired a 20% interest in the

Q41: Which of the following individuals can be

Q72: Under the marshaling of assets doctrine,personal creditors

Q86: General Telephone gave Wynonna $2,000 for an

Q93: Juan and Dorothy purchase a new residence

Q135: Self-employed salesman spends $200 on meals while