REFERENCE: Ref.10_05

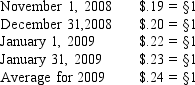

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-How is the disposition of the remeasurement gain or loss reported on the parent company's financial statements?

Definitions:

Pure Monopoly

A market structure where a single supplier provides a unique product or service without any close substitutes, giving it significant control over market prices.

Differentiated Products

Goods or services that are distinguished from similar offerings by unique characteristics, branding, quality, or performance, allowing companies to compete other than on price.

Standardized Products

Goods or services that are uniform in quality and specifications across producers, allowing them to be interchangeable.

Sequential Games

A type of game in game theory where players make decisions one after another, allowing for consideration of previous moves.

Q29: For each of the following transactions,select the

Q32: Assume the functional currency is the U.S.dollar,compute

Q37: Filings with the SEC are divided generally

Q42: Robert receives a car as a gift

Q47: What information is required in proxy statements?<br>(1)Five-year

Q60: What is the total partnership capital after

Q67: In translating a foreign subsidiary's financial statements,which

Q71: Filing status<br>A)Unmarried without dependents.<br>B)Generally used when financial

Q84: Sara constructs a small storage shed

Q105: The income reported by Dodge for 2008