REFERENCE: Ref.10_05

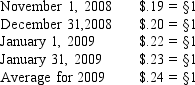

A subsidiary of Porter Inc. ,a U.S.company,was located in a foreign country.The functional currency of this subsidiary was the stickle (§) .The subsidiary acquired inventory on credit on November 1,2008,for §120,000 that was sold on January 17,2009 for §156,000.The subsidiary paid for the inventory on January 31,2009.Currency exchange rates between the dollar and the stickle were as follows:

-When preparing a consolidating statement of cash flows,which of the following statements is false?

Definitions:

Exchange Rates

The worth of one currency when converted to another, establishing how much one currency can be exchanged for another.

Operating Expense

Recurring expenses incurred during normal business operations, such as rent, utilities, and salaries.

Parent Corporation

A larger corporation that owns more than half the stock of another firm, allowing it to control the subsidiary's management and operations.

Foreign Subsidiary

A company owned or controlled by another company (the parent) but located and operating in a country different from the parent company.

Q13: Compute the amount of total liabilities with

Q35: What was Young's share of income or

Q49: Thomas has adjusted gross income of $228,000,

Q58: For a foreign subsidiary that uses the

Q58: Eden acquired a 20% interest in the

Q65: Material participation requires that an individual participates

Q70: What term is used for the ranking

Q76: Which of the following type of organization

Q77: Gordon is the sole shareholder of Whitman

Q140: Which of the following properties from an