REFERENCE: Ref.10_13

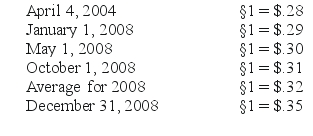

Boerkian Co.started 2008 with two assets: cash of §26,000 (stickles)and land that originally cost §72,000 when acquired on April 4,2004.On May 1,2008,the company rendered services to a customer for §36,000,an amount immediately paid in cash.On October 1,2008,the company incurred an operating expense of §22,000 that was immediately paid.No other transactions occurred during the year.Currency exchange rates were as follows:

SHAPE \* MERGEFORMAT

-Assume (1)that Boerkian was a foreign subsidiary of a U.S.multinational company that used the U.S.dollar as its reporting currency and (2)that the U.S.dollar was the functional currency of the subsidiary.What was the remeasurement gain or loss for 2008?

Definitions:

Absenteeism

The frequent absence from work or other duties without good reason, which can impact productivity and operations.

Honeymoon Effect

A phenomenon where newly-hired employees experience a high level of satisfaction and positivity towards their job, which can temporarily boost their performance.

Procedural Fairness

A concept emphasizing the importance of fair and impartial processes in decision-making, leading to increased acceptability of decisions.

Interactional Fairness

The perceived fairness of the interpersonal treatment people receive when organizational procedures are implemented.

Q5: On a statement of financial affairs,a company's

Q21: Which one of the following is not

Q56: Salaries and wages that have been earned

Q60: Chad pays $2,000 of interest on $20,000

Q67: Split basis<br>A)Begins on the day after acquisition

Q68: Compute ending inventory for 2009 under the

Q91: When an investor sells shares of its

Q93: Juan and Dorothy purchase a new residence

Q98: How much income did Harley report from

Q126: Lillian and Michael were divorced last year.