REFERENCE: Ref.01_14

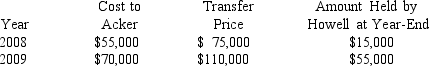

Acker Inc.bought 40% of Howell Co.on January 1,2008 for $576,000.The equity method of accounting was used.The book value and fair value of the net assets of Howell on that date were $1,440,000.Acker began supplying inventory to Howell as follows:

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

-What is the Equity in Howell Income that should be reported by Acker in 2008?

Definitions:

Financier Lessor

An entity engaged in the business of leasing out assets, typically providing the finance to purchase the asset which is then leased to the user.

Lease Receivable

An asset representing the right to receive future lease payments from lessees under lease agreements, reflecting the value of the asset leased out.

Operating Leases

Leases in which the lessee obtains the right to use an asset for a short period of time, without assuming the risks and rewards of ownership.

Initial Direct Costs

Expenses that are directly attributable to negotiating and arranging a lease, which are added to the carrying amount of the leased asset or deducted from the leasing income.

Q17: How much goodwill is associated with this

Q18: Gerald purchases a new home on June

Q19: What was the balance in the Investment

Q21: What was the reported balance of Harley's

Q34: Reed,Sharp,and Tucker were partners with capital account

Q34: Pursley,Inc.acquires 10% of Ritz Corporation on January

Q44: What exchange rate should be used to

Q61: Compute safe cash payments after the noncash

Q71: Mario's delivery van is completely destroyed when

Q122: Tim owns 3 passive investments. During