REFERENCE: Ref.01_14

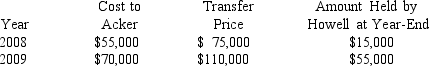

Acker Inc.bought 40% of Howell Co.on January 1,2008 for $576,000.The equity method of accounting was used.The book value and fair value of the net assets of Howell on that date were $1,440,000.Acker began supplying inventory to Howell as follows:

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

Howell reported net income of $100,000 in 2008 and $120,000 in 2009 while paying $40,000 in dividends each year.

-What is the balance in Acker's Investment in Howell account at December 31,2009?

Definitions:

Office Improvements

Enhancements or modifications made to office spaces, which may include renovations, decorations, or installation of new equipment to improve functionality or aesthetics.

Amortize

The process of gradually writing off the initial cost of an asset over a period.

Useful Life

The estimated duration a fixed asset is expected to be usable for its intended purpose, impacting depreciation calculations.

Lease Space

The act of renting property or area for business purposes, such as office or retail space.

Q5: What is a company's functional currency?<br>A)the currency

Q6: What argument could be made against the

Q11: Which of the following taxpayers can claim

Q35: Total free assets available for all unsecured

Q46: What is meant by a "fully secured

Q62: To what does the term Chapter 7

Q70: Jenny purchased 1,000 shares of Hewlett Corporation

Q85: What amount of equity income should Deuce

Q128: Carey and Corrine are married and have

Q158: Morris is a single individual who has