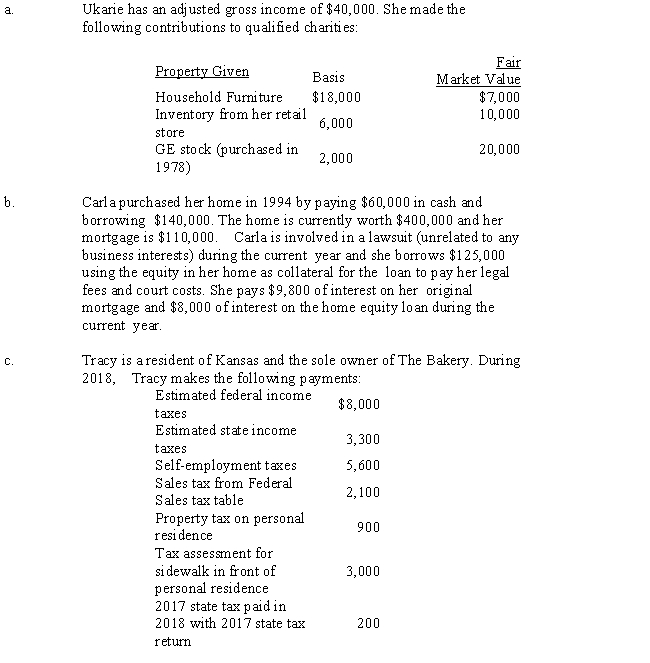

For each of the following situations, determine the amount of the allowable deduction. Be sure to show any necessary calculations and provide explanations of how you determined the deductible amount.

Definitions:

Business Combination

A transaction in which an acquirer gains control of one or more businesses.

Consolidated Expenses

The total expenses of a group of companies after eliminating intercompany transactions, reported in consolidated financial statements.

Fair Value

An estimate of the price at which an asset or liability could be traded in a fair transaction between willing parties, other than in a forced or liquidation sale.

Additional Paid-In Capital

Additional Paid-In Capital (APIC) is the amount of money that investors have paid for shares above their nominal value during public offerings, reflecting capital that a company receives in excess of the par value of its stock.

Q9: How much income did Mehan report from

Q30: Carlotta pays $190 to fly from Santa

Q51: Nonrecourse debt<br>A)A loss that is generally not

Q59: Judy and Larry are married and

Q79: All of the following statements regarding the

Q81: What is the primary objective of the

Q86: What is the balance in Acker's Investment

Q99: A passive activity<br>I.includes any trade or business

Q125: Organization costs<br>A)Capitalized and amortized over a number

Q130: Explain the support test and the gross