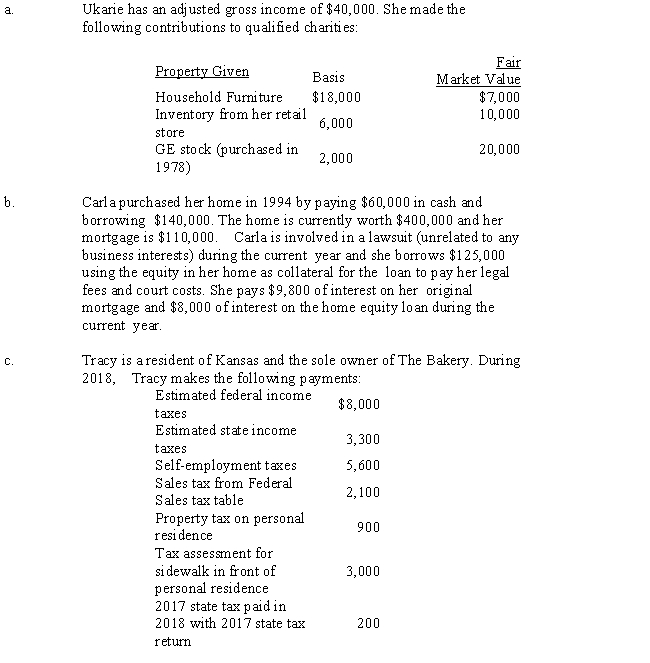

For each of the following situations, determine the amount of the allowable deduction. Be sure to show any necessary calculations and provide explanations of how you determined the deductible amount.

Definitions:

Partial Hospitalization

A type of program that provides individuals with intense but not 24-hour treatment, often used for mental health disorders and allowing patients to spend evenings at home.

Social Skills

The abilities necessary for successful social communication and interaction, including empathy, understanding social cues, and conflict resolution.

Support Group

A gathering of individuals who share common experiences and challenges, offering each other emotional and moral support.

Sheltered Workshop

A workplace that provides employment and training for people with disabilities under a protected and supervised environment.

Q3: Idler Co.has an investment in Cowl Corp.for

Q13: On February 3 of the current year,

Q42: An upstream sale of inventory is a

Q59: In a situation where the investor exercises

Q78: Reiko buys 200 shares of Saratoga Corporation

Q96: Why did Congress enact the at-risk rules?

Q119: Taxpayer contribution of $250 to the Democratic

Q132: Jennifer pays the following expenses for

Q136: Which of the following is/are currently deductible

Q165: Using the general tests for deductibility, explain