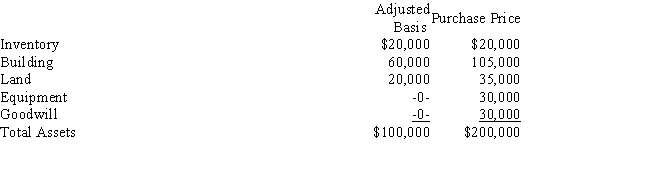

Dorothy operates a pet store as a sole proprietorship. During the year, she sells the business to Florian for $200,000. The assets sold and the allocation of the purchase price are as follows:

Dorothy acquired the building in 1997 for $100,000 of which $20,000 was allocated to the land. She paid $40,000 for the equipment in the same year. What are the tax consequences of the liquidation for Dorothy?

Definitions:

Product Category

A classification of products that share common features or are aimed at meeting a similar need or interest.

Strategic Edge

The unique advantage a company gains over competitors by implementing effective strategies that leverage its strengths or market conditions.

Marketing Advantage

The competitive edge or superiority a company has over its rivals in attracting and retaining customers.

Marketing Mix

A set of actions, or tactics, that a company uses to promote its brand or product in the market, typically encapsulated by the four Ps: Product, Price, Place, and Promotion.

Q3: Mountain View Development Co. purchases a new

Q4: Depreciable basis<br>A)The depreciation method for real estate.<br>B)A

Q14: Greenville Floral places a new tractor (7-year

Q21: Omicron Corporation had the following capital

Q23: On December 1, 2016, George paid $17,500

Q28: A guaranteed payment is a payment made

Q34: Drew traded his office copier in for

Q93: Roscoe receives real estate appraised at $200,000

Q99: Section 1231 property<br>A)Stocks, bonds, options.<br>B)Depreciable real property.<br>C)All

Q99: For related parties to qualify for a