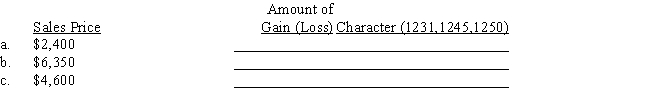

Maria acquired a personal computer to use 100% in her business for $6,000. She took MACRS deductions of $2,880 before selling it in current year. Determine the amount and character of the gain (loss) recognized on the sale of the computer, assuming a sales price that differs in each of the three independent situations:

Definitions:

Lipid Molecule

Organic molecules that are fatty acids or their derivatives and are insoluble in water but soluble in organic solvents.

Phospholipid

Molecule that forms the bilayer of the cell’s membranes; has a polar, hydrophilic head bonded to two nonpolar, hydrophobic tails.

Functional Group

A specific grouping of atoms within a molecule that is responsible for a characteristic chemical reaction.

Carbohydrate Molecules

Organic compounds consisting of carbon, hydrogen, and oxygen, serving as a major energy source for the body.

Q5: _ are open to hearing different views

Q9: This type of delivery style, one of

Q45: Which of the following intangible assets is

Q49: A tax rate that remains the same

Q65: On a nonliquidating distribution of cash from

Q75: Monica acquires a 25% interest in Terrapin

Q80: Nigel and Frank form NFS, Inc. an

Q97: Partnership<br>A)An entity with conduit tax characteristics that

Q101: Manu bought Franklin's ownership interest in Antoine

Q130: An annual loss results from an excess