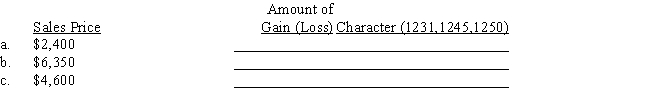

Maria acquired a personal computer to use 100% in her business for $6,000. She took MACRS deductions of $2,880 before selling it in current year. Determine the amount and character of the gain (loss) recognized on the sale of the computer, assuming a sales price that differs in each of the three independent situations:

Definitions:

Interrogate

To ask questions closely, aggressively, or formally, often for the purpose of obtaining truth or information.

Remuneration

Payment or compensation received for services rendered or work performed.

Terminate

To bring something to an end or conclude its operation.

Paraphrasing

The act of rewording a text or passage to express the same meaning in a different way, often to clarify or simplify.

Q13: What is the definition of cumulative effect

Q32: George sells his personal use automobile at

Q35: Land in London, England for land in

Q36: Sarah owes a deductible expense that she

Q57: Self-employed people are required to make quarterly

Q67: For 2018, Nigel and Lola, married taxpayers

Q69: Dallas Wildcat Drilling Co. sells an oil-drilling

Q79: Horizontal equity<br>I.means that those taxpayers who have

Q89: On February 19, 2016, Woodbridge Corporation granted

Q92: Section 1245 property is subject to a