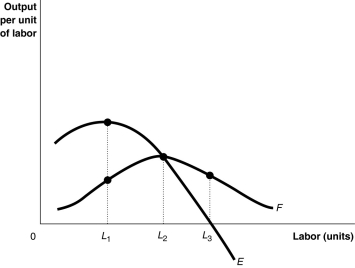

-Refer to Figure 7-2. Short run output is maximised at

Definitions:

LIFO Cost

LIFO (Last In, First Out) Cost refers to an inventory valuation method where the most recently acquired items are the first to be sold or used, affecting the cost of goods sold and inventory valuation.

Net Income

The amount of money left over after all operating expenses, taxes, and interest are subtracted from total revenue.

Physical Flow

The movement of physical goods through a production process or supply chain.

FIFO Inventory

A rephrased definition: A method to manage and value inventory assuming the first items purchased are the first to leave the warehouse.

Q27: What do economists mean by an efficient

Q38: If,for a given output level,a perfectly competitive

Q47: Which of the following are implicit costs

Q56: What is the relationship among the following

Q128: If marginal benefit is greater than marginal

Q134: Refer to Figure 8-16.If the market price

Q186: If equilibrium is achieved in a competitive

Q217: A curve that shows all the combinations

Q263: Refer to Table 7-7.What is the marginal

Q297: Average total cost is<br>A)total cost divided by