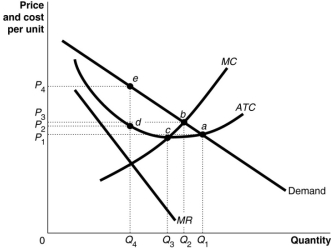

Figure 10.14

-Refer to Figure 10.14.If the diagram represents a typical firm in the market, what is likely to happen in the long run?

Definitions:

Capital Structure

Refers to the way a corporation finances its assets through a combination of debt, equity, or hybrid securities.

Total Leverage

A financial metric that assesses the impact of using both operating and financial leverage on a company's earnings per share.

Operating Leverage

A measure of how revenue growth translates into growth in operating income, indicating how fixed and variable costs impact a firm's earnings.

Optimal Capital Structure

The combination of debt and equity that minimizes a company's cost of capital and maximizes its value.

Q21: To have a monopoly in an industry

Q24: If the labour demand curve shifts to

Q47: Productive efficiency does not hold for a

Q60: Decision trees are commonly used to illustrate

Q72: Which of the following statements applies to

Q87: A table that shows the possible payoffs

Q122: Which of the following is the best

Q131: When workers are paid on a piece-rate

Q198: If it is difficult for a firm

Q245: Holding the price of a firm's output