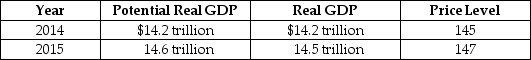

Table 26-1

-Refer to Table 26-1. The hypothetical information in the table shows what the values for real GDP and the price level will be in 2015 if the Fed does not use monetary policy. Which of the following policies makes sense if the Fed wants to keep real GDP at its potential level in 2015?

Definitions:

Capital Investment Analysis

The process by which management plans, evaluates, and controls investments in fixed assets.

Present Value

The value of an asset or cash at present that is equivalent in value to a specified sum in the future.

Average Rate of Return

A financial ratio used to estimate the profitability of an investment, calculated by dividing the average annual profit by the initial investment cost.

Average Rate of Return

A calculation to determine the profitability of an investment, measuring the average annual return over the investment's lifespan compared to the initial cost.

Q84: Your income will increase if the Federal

Q132: Monetary policy refers to the actions the<br>A)

Q143: In countries that have experienced hyperinflation, what

Q165: An increase in the money supply will<br>A)

Q218: If the federal budget has an actual

Q226: If the Fed raises the interest rate,

Q246: The Taylor rule helps explain the relationship

Q249: Although gold is highly valued by most

Q261: Describe the differences (in sign and relative

Q302: Following a decrease in government spending, as