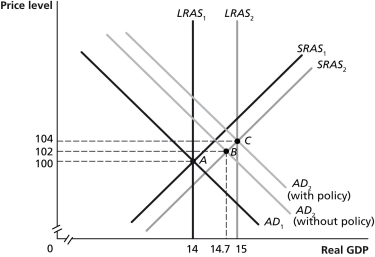

Figure 26-15

-Refer to Figure 26-15. In the figure above, suppose the economy in Year 1 is at point A and expected in Year 2 to be at point B. Which of the following policies could the Federal Reserve use to move the economy to point C?

Definitions:

Yield To Maturity

The total return anticipated on a bond if the bond is held until its maturity date, taking into account its current market price, face value, interest rate, and time to maturity.

Semi-Annually

Occurring or conducted twice a year.

Face Value

The nominal or dollar value printed on a bond, stock, or other financial instrument, representing the amount due at maturity.

Coupon Rate

The interest rate on a bond paid by the issuer, which is a fixed percentage of the bond's face value, yielding regular interest payments to the bondholder.

Q4: Suppose you deposit $2,000 into Bank of

Q22: If the Federal Reserve announces that its

Q84: Suppose Warren Buffet withdraws $1 million from

Q92: Economists who believe the supply-side effects of

Q104: Suppose the equilibrium real federal funds rate

Q143: An increase in individual income taxes _

Q208: Which of the following statements about inflation

Q232: Which of the following would be considered

Q266: The cyclically adjusted budget deficit or surplus

Q278: A bank holds its reserves as _