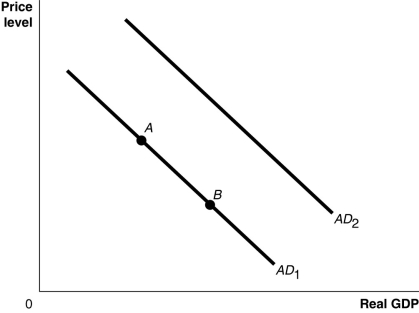

Figure 24-1 -Refer to Figure 24-1.Ceteris Paribus,an Increase in Households' Expectations of Households

Figure 24-1

-Refer to Figure 24-1.Ceteris paribus,an increase in households' expectations of their future income would be represented by a movement from

Definitions:

European Put Option Delta

European Put Option Delta quantifies the sensitivity of the price of a European put option to changes in the price of the underlying asset, representing the price movement correlation.

Random Variable

A variable whose possible values are outcomes of a stochastic process, often used in probability and statistics.

Option's Value

The intrinsic and extrinsic value of an options contract, which determines its worth at a given point in time.

Black-Scholes Option Pricing Model

A mathematical model used to estimate the price of European-style options, incorporating factors such as volatility and time to expiration.

Q8: In response to the destructive bank panics

Q13: Refer to the Article Summary. The increase

Q53: If national income increases by $75 million

Q58: If, during a deposit expansion, not all

Q68: Refer to Scenario 25-2. As a result

Q121: Explain the three reasons the aggregate demand

Q161: Which of the following is an appropriate

Q191: In the United States, currency includes<br>A) gold,

Q208: Household spending on goods and services is

Q268: If the U.S. dollar increases in value