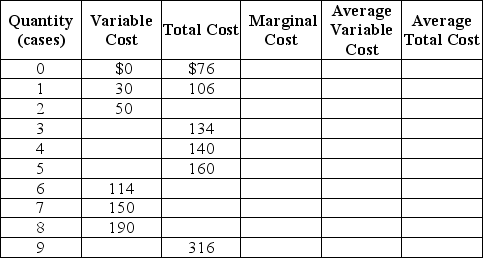

Werner & Sons is a manufacturer of three-ring binders operating in a perfectly competitive industry.Table 12-5 shows the firm's cost schedule.

Table 12-5

Use the table to answer the following questions.

a. Complete Table 12-5 by filling in the blank cells.

b. Werner is selling in a perfectly competitive market at a price of $40. What is the profit-maximizing or loss-minimizing output?

c. Calculate the firm's profit or loss.

d. Should the firm continue to produce in the short run? Explain.

e. If the firm's fixed costs were $30 higher what would be the profit-maximizing output level in the short run? Indicate whether the output level will increase, decrease, or remain unchanged compared to your answer in b.

f. Suppose fixed cost remains at $76. If the price of three-ring binders falls to $20 what is the profit-maximizing or loss-minimizing output?

g. Calculate the profit or loss. Should the firm continue to produce in the short run? Explain your answer.

h. Suppose the fixed cost remains at $76. What price corresponds to the shut-down point?

i. Suppose the fixed cost remains at $76. What price corresponds to the break-even point?

Definitions:

December

The last month of the year according to the Gregorian calendar, which is the twelfth one.

Merchandise

Goods that are purchased in finished form for the purpose of resale without further processing.

Cash Balance

The total amount of cash in a company's accounts at any given time.

December

In the Gregorian calendar, the year concludes with its twelfth month.

Q5: Refer to Table 13-2. What is likely

Q14: Which of the following is not a

Q27: Which of the following statements is true

Q43: Refer to Figure 13-4. If the firm

Q66: Refer to Figure 12-9. At price P1,

Q91: Which of the following statements is generally

Q131: Refer to Figure 13-13. If the diagram

Q225: Refer to Figure 12-2. Why is the

Q233: Monopolistically competitive firms achieve allocative efficiency but

Q302: Refer to Figure 11-11. For output rates