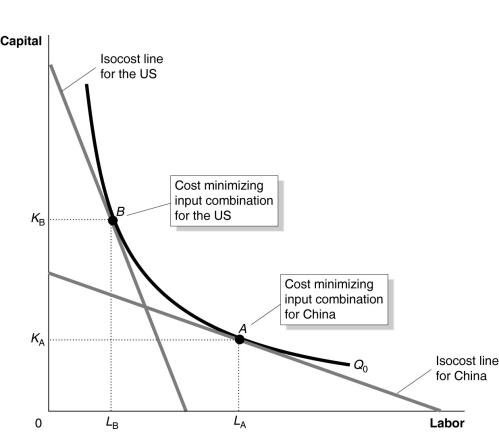

Figure 11-14  Figure 11-14 shows the optimal input combinations for the production of a given quantity of cotton in the United States and in China.

Figure 11-14 shows the optimal input combinations for the production of a given quantity of cotton in the United States and in China.

-Refer to Figure 11-14. Consider the following statements:

a. For each country, the marginal product per dollar spent on labor equals to the marginal product per dollar spent on capital.

b. The price of labor is relatively higher in the United States than in China and the price of capital is relatively lower in the United States than in China.

c. The price of labor and the price of capital are relatively higher in the United States than in China.

Based on the figure, which of the statements above is true?

Definitions:

Selling Price

The amount of money for which a product or service is sold to customers.

Contribution Margin Ratio

A financial metric that measures how effectively a company can cover its variable costs with revenue, calculated as contribution margin divided by sales revenue.

Variable Cost Per Unit

The cost that changes in proportion to changes in the level of output or activity.

Income From Operations

The profit realized from a business's ongoing core business operations, excluding deductions of interest and taxes.

Q26: Refer to Table 10-6. What is Jay's

Q37: The formula for total fixed cost is<br>A)

Q39: If a consumer receives 22 units of

Q88: Refer to Table 10-2. Suppose Keira's income

Q109: Refer to Table 1-1. Using marginal analysis,

Q121: The substitution effect of a price increase

Q123: If a perfectly competitive firm achieves productive

Q126: Refer to Table 11-4. The table above

Q191: The change in a firm's total cost

Q215: Refer to Figure 10-8. If the price