Use the design shown in Figure 8.1 to construct a complete repayment schedule including the totaling of the Amount Paid, Interest Paid, and Principal Repaid columns for the following loan.

On April 22, Tim borrowed $2900.00 from Keewatin Credit Union at 6.5% per annum calculated on the daily balance. He gave the Credit Union four cheques for $535.00 dated the 15th of each of the next four months starting May 15 and a cheque dated October 15 for the remaining balance to cover payment of interest and repayment of principal.

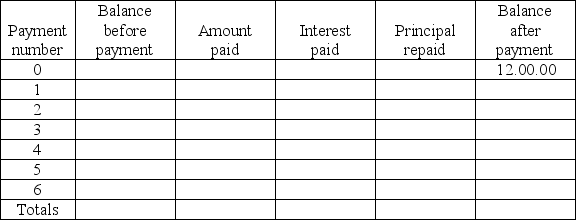

-You borrowed the amount indicated in the Balance after payment column of the following schedule from your friendly credit union. You agreed to repay the loan in monthly payments equal to  of the original loan, including interest due and principal. Interest is charged at a rate of 12.2% per annum computed on the monthly balance.

of the original loan, including interest due and principal. Interest is charged at a rate of 12.2% per annum computed on the monthly balance.

Repayment Schedule

Required: Complete the repayment schedule (this includes totaling of the Payment, Interest paid and Principal repaid columns to check the accuracy of your work).

Required: Complete the repayment schedule (this includes totaling of the Payment, Interest paid and Principal repaid columns to check the accuracy of your work).

a) What is the loan balance after the third payment?

b) What is the total amount needed to repay the loan?

Definitions:

Safety Stock

Inventory kept on hand as a buffer against supply or demand uncertainties, ensuring that stockout situations are minimized.

Holding Costs

The expenses associated with storing unsold goods or materials, including storage, insurance, and opportunity costs.

Housing Costs

The expenses associated with acquiring, maintaining, and using a place to live, including rent, mortgage payments, taxes, and maintenance fees.

Material Handling

The logistics of moving, protecting, warehousing, managing, and disposing of materials and products from the start of production, through the distribution process, to consumption and eventual elimination.

Q4: What sum of money invested at 8%

Q19: The gas division of Power-U-Up plans to

Q23: Compute the accumulated value of $10 000.00

Q34: A bakery has been baking 4000 donuts

Q39: If $3000.00 is invested for seven years

Q53: What sum of money will accumulate to

Q62: A $15000.00 loan requires payments at the

Q64: A rental property provides a monthly income

Q106: Your gas bill for March is $274.40.

Q115: A debt of $5000.00 is to be