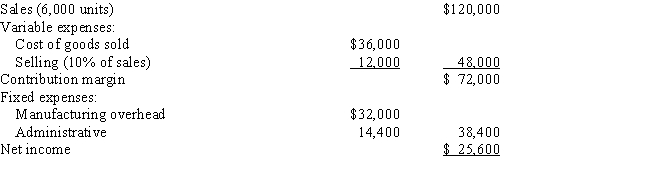

The variable costing income statement for Kilem Company for this year is as follows:  Selected data for this year concerning the operations of the company are as follows: Required: Prepare an absorption costing income statement for this year.

Selected data for this year concerning the operations of the company are as follows: Required: Prepare an absorption costing income statement for this year.

Definitions:

Bankruptcy Court

A specialized court that deals with cases involving bankruptcy filings and related proceedings.

Final Settlement

The last payment in an agreement, settling all outstanding balances and obligations.

Section 179

A provision in the U.S. tax code that allows businesses to deduct the full purchase price of qualifying equipment and/or software within the tax year it was purchased.

Maximum Deduction

The highest amount that can be subtracted from taxable income, as allowed by tax laws.

Q2: Refer to the Figure.How many standard hours

Q5: Partially completed units can be worked on

Q36: Sterling Manufacturing has developed the following

Q46: Giant Company is a job-order costing

Q63: A company plans to sell 450 units.The

Q74: If actual overhead is greater than applied

Q78: Avonlea Construction builds custom houses for individual

Q80: Briefly describe the advantages and disadvantages of

Q93: Budgets identify objectives and the actions needed

Q131: Refer to the Figure.What was the labour