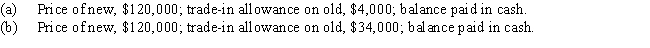

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date)is exchanged for similar machinery.Assume that the transaction has commercial substance.For financial reporting purposes,present entries to record the exchange of the machinery under each of the following assumptions:

Definitions:

Operating Expenses

Recurring expenses related to the core operations of a business, excluding the cost of goods sold, such as rent, utilities, and salaries.

Net Income

The net income a business generates once all costs and taxes are deducted from its total revenue.

Units Sold

The total quantity of products sold within a specific timeframe.

Product Cost

The total expenses incurred to produce a product or service, including direct materials, labor, and manufacturing overhead costs.

Q5: Using the following information,prepare a bank reconciliation

Q12: The patient has vancomycin 1250 mg ordered

Q36: During the taking of its physical inventory

Q37: The physician orders fluconazole 200 mg twice

Q69: FIFO is the inventory costing method that

Q71: There are three internal control objectives and

Q106: Capital expenditures are costs that are charged

Q124: You are trying to explain debit and

Q126: During a period of consistently rising prices,the

Q163: The maturity value of a note receivable