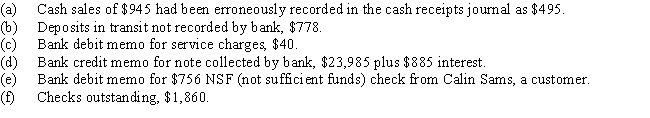

The bank statement for Jeffrey Co.indicates a balance of $8,785 on October 31.After the journal entries for October had been posted,the cash account had a balance of $8,998.

Record the appropriate journal entries that would be necessary for Jeffrey Co.

Definitions:

Tax Basis

The value of an asset for tax purposes, used to calculate capital gains or losses upon disposition of the asset.

Salvage Value

The estimated value that an asset will realize upon its sale at the end of its useful life.

Reportable Segment

A part of an organization distinguished by its business activities, products, or services, which is significant enough to require separate financial reporting under financial reporting standards.

Revenues

The total amount of income generated by the sale of goods or services related to the company's primary operations.

Q8: Equipment acquired at a cost of $126,000

Q12: At the end of the current year,Accounts

Q12: When using the FIFO inventory costing method,the

Q17: Discuss the (a)focus and (b)financial statement emphasis

Q35: The bank statement for Gatlin Co.indicates a

Q70: Under the perpetual inventory system,when a sale

Q87: Revising depreciation estimates affects the amounts of

Q90: Equipment was acquired at the beginning of

Q138: Under the perpetual inventory system,a company purchases

Q158: "Market" as used in the phrase "lower