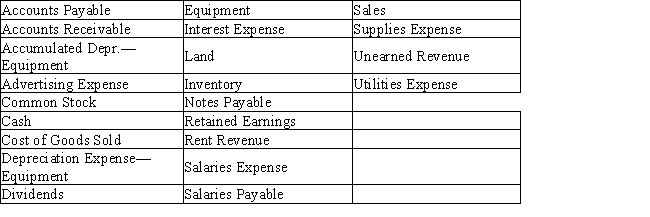

Using the list of accounts below,construct a chart of accounts for a merchandising business that rents out a portion of its building,and assign account numbers and arranging the accounts in balance sheet and income statement order ("1" for assets,and so on).Each account number should have three digits.Contra accounts should be designated with a decimal of the account (100.1 for contra of account 100).Assets and liabilities should be in order of liquidity,expenses should be in alphabetical order.

Definitions:

Total Liabilities

The combined debts and obligations that a company owes to outside parties at any given time.

Accrued Expenses

Expenses that have been incurred but not yet paid for, often recognized in accounting through an adjusting entry.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the consumption of the asset's value over time.

Record Depreciation Expense

The process of allocating the cost of tangible assets over their useful lives to accurately reflect their consumption and wear and tear.

Q30: Supplies are recorded as assets when purchased.Therefore,the

Q37: When comparing a retail business to a

Q76: The seller may prepay the freight costs

Q87: At the end of the fiscal year,the

Q106: Which of the following accounts are debited

Q115: The amount of the outstanding checks is

Q137: The adjusted trial balance verifies that total

Q140: Depreciation on equipment for the year is

Q153: Prepaid Insurance is an example of a

Q166: Which of the following has steps of