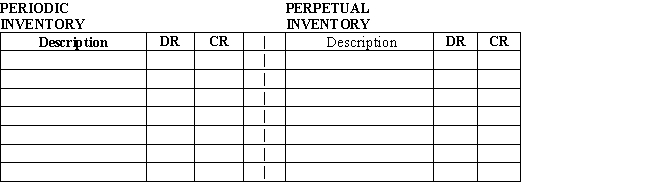

Journalize the following transactions for Armour Inc.using both the periodic inventory system and the perpetual inventory system,presented in the side-by-side format of the form provided below.

Oct.7 Sold $1,200 of merchandise on credit to Rondo Distributors,terms n / 30; the cost of the merchandise was $720.

Oct.8 Purchased merchandise,$10,000; terms FOB shipping point and 2 / 15,n / 30; with prepaid freight charges of $525 added to the invoice.

Definitions:

Net Annual Operating

Typically refers to the net operating income or profit generated by a business over the course of a year, excluding non-operating revenues and expenses.

After-Tax Discount Rate

The rate used to discount future cash flows of an investment after taxes have been accounted for, reflecting the investor's required rate of return net of taxes.

Working Capital

The difference between a company's current assets and current liabilities, indicating the short-term liquidity.

Straight-Line Depreciation

This method evenly allocates the cost of an asset over its useful life.

Q2: The closing process is sometimes referred to

Q7: The increase side of an account is

Q11: Journalize the following transactions in the accounts

Q19: Debts listed as current liabilities are those

Q68: The journal entry to record the receipt

Q83: The accounting principle upon which deferrals and

Q99: Adjusting entries affect balance sheet accounts to

Q104: Which of the following items that appeared

Q165: Indicate whether each of the following would

Q174: Transactions are listed in the journal chronologically.