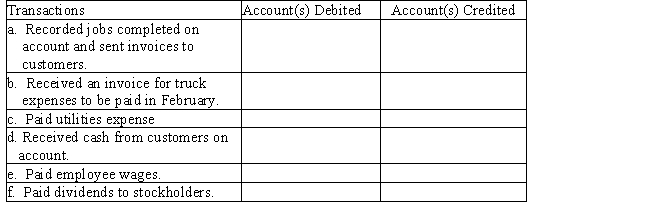

On January 1,Merry Walker and other stockholders established a catering service.Listed below are accounts to use for transactions (a)through (f),each identified by a number.Following this list are the transactions that occurred in Walker's first month of operations.You are to indicate for each transaction the accounts that should be debited and credited by placing the account number(s)in the appropriate box.

Definitions:

Partnership Liquidation

The process of closing a partnership business, including selling off assets, paying off debts, and distributing the remaining assets to the partners.

Personal Assets

Assets owned by an individual as opposed to assets owned by businesses or corporations, including properties, account balances, and personal belongings.

Unlimited Liability

A legal structure in which the business owner's personal assets can be used to satisfy the business debts and liabilities.

Mutual Agency

A principle of partnership where each partner has the authority to bind the partnership in contractual agreements.

Q42: A make-to-order company matches its production schedules

Q46: The classified balance sheet will show which

Q63: Data for an adjusting entry described as

Q68: Which of the following is true regarding

Q93: To determine the balance in an account,always

Q112: The entry to close expenses would be:<br>A)

Q121: Tennessee Corporation is analyzing a capital expenditure

Q139: The amount of income that would result

Q155: The expected period of time that will

Q186: The right hand side of a T