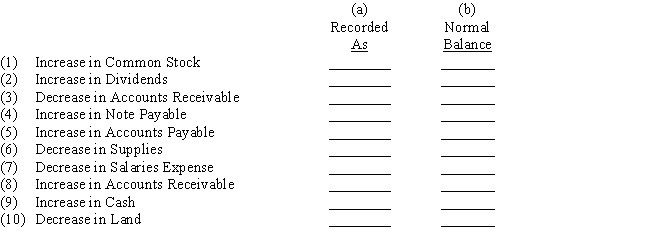

Increases and decreases in various types of accounts are listed below.In each case,indicate by "Dr." or "Cr." (a)whether the change in the account would be recorded as a debit or a credit and (b)whether the normal balance of the account is a debit or a credit.

Definitions:

Distorting Taxes

Taxes that alter the allocation of resources and change consumer or producer behavior, leading away from an efficient market outcome.

Excess Burdens

Refers to the additional costs or losses to society beyond the direct financial effects, caused by inefficiencies or distortions in market transactions.

Benefits-Received Principle

A theory of taxation wherein individuals pay taxes in proportion to the benefits they receive from government services.

Camping Fee

A charge for the privilege of accessing and using facilities or spaces designated for camping.

Q8: Classify the following items as: (1)prepaid expense,(2)unearned

Q19: Debts listed as current liabilities are those

Q48: Generally accepted accounting principles require accrual-basis accounting.

Q71: The budgeted cell conversion cost rate includes

Q86: Adjustments for accruals are needed to record

Q100: Sets the price according to demand<br>A)Demand-based concept<br>B)Competition-based

Q104: Within-batch wait time increases total lead time.

Q108: Record journal entries for the following transactions.<br><br>(a)On

Q159: Several transactions are listed below,with the accounting

Q184: Determine the average rate of return for