Project A requires an original investment of $65,000.The project will yield cash flows of $15,000 per year for 7 years.Project B has a calculated net present value of $5,500 over a 5-year life.Project A could be sold at the end of 5 years for a price of $30,000.(a)Using the table below,determine the net present value of Project A over a 5-year life with salvage value assuming a minimum rate of return of 12%.(b)Which project provides the greatest net present value?

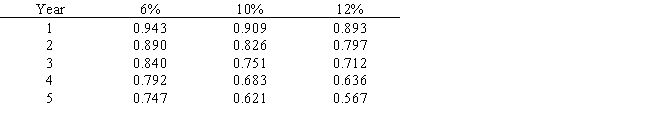

Below is a table for the present value of $1 at compound interest.

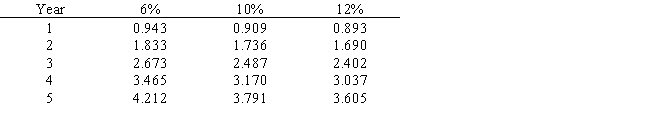

Below is a table for the present value of an annuity of $1 at compound interest.

Below is a table for the present value of an annuity of $1 at compound interest.

Definitions:

Trade Restriction

Measures implemented by governments to control the amount of trade across borders, including tariffs, quotas, and non-tariff barriers.

Production Relationships

The correlations between input factors and the resulting output in the production process of goods or services.

Production Possibilities Frontier

A graph showing all the possible highest production levels for two or more products, given certain inputs.

Trade

The act of buying, selling, or exchanging goods and services between people, firms, or countries.

Q23: Connally Company's payroll department required that every

Q31: What will the income of the Macro

Q42: Piper Rose Boutique has been approached by

Q49: In a lean environment,operations only respond to

Q66: Which side of the account increases the

Q99: The post reference notation used in the

Q109: Ideal standards are developed under conditions that

Q110: For a month's transactions for a typical

Q110: Which of the following would be most

Q157: Controllable expenses are those that can be