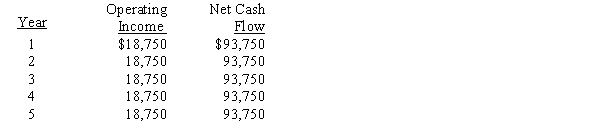

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The expected average rate of return for a proposed investment of $650,000 in a fixed asset, with a useful life of 4 years, straight-line depreciation, no residual value, and an expected total net income of $240,000 for the 4 years, is

Definitions:

Garage Sale

A sale of used household or personal items held privately, typically in the seller's garage or yard.

Battery

A criminal offense involving the unlawful physical acting upon a threat, notably harming another person.

Negligence

A failure to behave with the level of care that someone of ordinary prudence would have exercised under the same circumstances, often leading to harm or damage.

Standard Of Care

The level of care and attention expected of a person or organization in carrying out activities, especially to avoid harm to others.

Q38: For Years 1-5,a proposed expenditure of $250,000

Q82: Property tax expense for a department store's

Q96: Which of the following results in fewer

Q99: The amount of the estimated average income

Q102: When a bottleneck occurs between two products,the

Q107: The process by which management allocates available

Q123: The adjusting entry for gym memberships earned

Q127: What posting references will be found in

Q140: Motel Corporation is analyzing a capital expenditure

Q144: The net present value for this investment