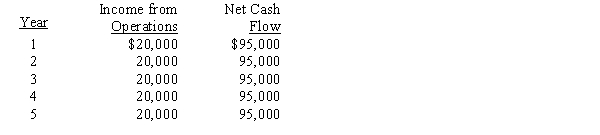

The management of River Corporation is considering the purchase of a new machine costing $380,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The average rate of return for this investment is

Definitions:

Direct Labor Rate Variance

This measures the difference between the actual cost of direct labor and the expected (or standard) cost, calculated by comparing the actual rates paid to workers versus the planned rates.

Overhead

All ongoing business expenses not directly attributed to creating a product or service. This includes costs like rent, utilities, and salaries of employees not directly involved in production.

Standard Labor Hours

Refer to the predetermined amount of time expected to be spent to complete a task under normal conditions.

Direct Labor Rate Variance

The difference between the actual labor rate paid to workers and the standard labor rate, multiplied by the total hours worked.

Q36: Lewis Company has a condensed income statement

Q56: Though favorable fixed factory overhead volume variances

Q58: The anticipated purchase of a fixed asset

Q72: A company should only use nonfinancial performance

Q78: Listed below are accounts to use for

Q90: Which of the following errors could cause

Q91: An example of a nonfinancial measure is

Q92: The manager of the furniture department of

Q173: Piper Corp.is operating at 70% of capacity

Q187: On November 1,Nikle Company made a cash