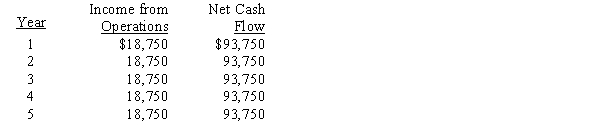

The management of Wyoming Corporation is considering the purchase of a new machine costing $375,000. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for five years is 4.212. In addition to the foregoing information, use the following data in determining the acceptability of this investment:

-The present value index for this investment is

Definitions:

Current Ratio

A liquidity ratio that measures a company's ability to pay short-term obligations with its current assets, calculated as current assets divided by current liabilities.

Acid-test Ratio

A strict measure used to assess if a company possesses sufficient current assets to pay off its short-term obligations without the need to liquidate its stock.

Times Interest

A metric that evaluates a firm's capability to handle its debt responsibilities using its present earnings.

Equity Multiplier

A financial ratio that measures a company's use of debt financing by comparing total assets to shareholders' equity.

Q47: Organize the following accounts into the usual

Q67: A bottleneck begins when demand for the

Q70: Differential analysis can aid management in making

Q86: Heart Company has two divisions.Division A is

Q98: A business pays biweekly salaries of $20,000

Q111: A responsibility center in which the department

Q113: An unfavorable cost variance occurs when budgeted

Q122: Assuming that Widgeon Co.can sell all of

Q126: A list of the accounts used by

Q167: Central Division for Chemical Company has a