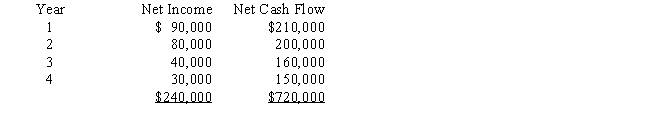

Vanessa Company is evaluating a project requiring a capital expenditure of $480,000.The project has an estimated life of 4 years and no salvage value.The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return for net present value analysis is 15%.The present value of $1 at compound interest of 15% for 1,2,3,and 4 years is 0.870,0.756,0.658,and 0.572,respectively.

The company's minimum desired rate of return for net present value analysis is 15%.The present value of $1 at compound interest of 15% for 1,2,3,and 4 years is 0.870,0.756,0.658,and 0.572,respectively.

Determine (a)the average rate of return on investment,using straight-line depreciation,and (b)the net present value.

Definitions:

Ideal Weight

A weight range considered to be the most beneficial for health, as determined by medical or fitness professionals based on factors like age, sex, and height.

Health Problems

Refers to any condition that affects an individual's physical or mental wellbeing.

Overweight

A condition characterized by weight that is higher than what is considered healthy for a given height, but not obese.

Body Mass Index

A numerical value derived from the weight and height of an individual, used to classify underweight, healthy weight, overweight, and obesity.

Q11: A company is planning to purchase a

Q20: Standards are designed to evaluate price and

Q27: Calculate the direct labor time variance.<br>A) $2,362.50

Q29: Starling Co.is considering disposing of a machine

Q38: Which of the following is best suited

Q63: The chart of accounts should be the

Q85: Which of the following is an example

Q118: The direct labor time variance measures the

Q146: In calculating the net present value of

Q154: The expected average rate of return for