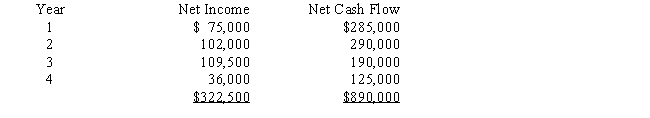

BAM Co.is evaluating a project requiring a capital expenditure of $806,250.The project has an estimated life of 4 years and no salvage value.The estimated net income and net cash flow from the project are as follows:

The company's minimum desired rate of return is 12%.The present value of $1 at compound interest of 12% for 1,2,3,and 4 years is 0.893,0.797,0.712,and 0.636,respectively.

Determine: (a)the average rate of return on investment,including the effect of depreciation on the investment,and (b)the net present value.

Definitions:

Logistic Regression

A statistical method for analyzing datasets in which there are one or more independent variables that determine an outcome, which is dichotomous.

Multiple Logistic Regression

A statistical technique that models the probability of a certain outcome or event based on more than one independent variable.

Explanatory Variables

Variables in a statistical model that are believed to explain or influence changes in a response variable.

Standard Deviation

A measure of the dispersion or variability within a set of data points, indicating how spread out the values are from the mean.

Q6: MZE Manufacturing Company has a normal plant

Q6: Lean manufacturing is also called make-to-stock manufacturing.

Q39: The three common types of responsibility centers

Q54: Target costing is arrived at by taking<br>A)

Q61: A manager in a cost center also

Q74: Lockrite Security Company manufacturers home alarms.Currently,it is

Q96: In net present value analysis for a

Q98: The management of Charlton Corporation is considering

Q108: Reducing wait time is directly linked to

Q120: The ratio of income from operations to