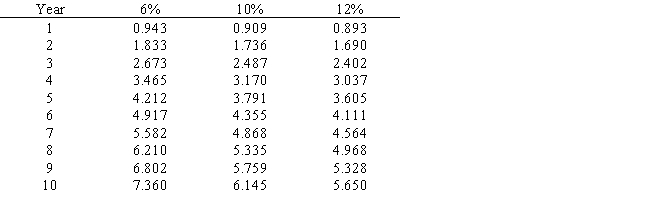

A project is estimated to cost $273,840 and provide annual net cash flows of $60,000 for 7 years.Determine the internal rate of return for this project,using the following present value of an annuity table.

Definitions:

Accountants

Professionals who perform accounting functions such as audits or financial statement analysis according to prescribed methods.

Inventory Valuation Method

The approach a company uses to determine the cost of its inventory, affecting the cost of goods sold and profitability; common methods include FIFO, LIFO, and weighted average.

Financial Statements

Formal reports detailing the financial activities and condition of a business, including the balance sheet, income statement, and cash flow statement.

Net Income

The total earnings of a company after subtracting all expenses, including taxes and operating costs.

Q7: The increase side of an account is

Q13: A lean nonmanufacturing process can be accomplished

Q16: Net income will result when<br>A) revenues (credits)>

Q19: From the foregoing information,determine the budgeted cell

Q60: Assume in analyzing alternative proposals that Proposal

Q90: The target cost approach assumes that:<br>A) markup

Q115: The markup percentage on total cost for

Q145: Which of the following is not considered

Q178: Indicate whether the following error would cause

Q190: Expenses can result from<br>A) selling stock<br>B) consuming