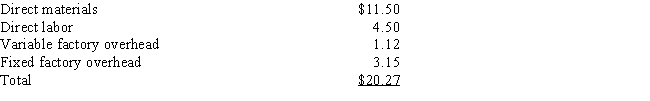

Snipe Company has been purchasing a component,Part Q for $19.20 per unit.Snipe is currently operating at 70% of capacity and no significant increase in production is anticipated in the near future.The cost of manufacturing a unit of Part Q is estimated as follows:

Prepare a differential analysis report,dated March 12 of the current year,on the decision to make or buy Part Q.

Prepare a differential analysis report,dated March 12 of the current year,on the decision to make or buy Part Q.

Definitions:

Acquisition Differential

The difference between the cost of acquiring a company and the fair value of its identifiable net assets.

Equity Method

An accounting technique used to record the investments in other companies, where the investment is significant but the investor does not have full control.

Patent

A legal right granted to an inventor for an exclusive period, typically 20 years, to exploit a new, useful, and non-obvious invention.

Consolidated Cash Flows

A statement merging the cash flows of a parent company and its subsidiaries to present the overall cash generated or used by the entire group.

Q1: Operating expenses incurred for the entire business

Q3: Miller and Sons' static budget for 10,000

Q49: In a lean environment,operations only respond to

Q53: The budgeted volume of production is based

Q72: What cost concept used in applying the

Q88: The balanced scorecard measures<br>A) only financial information<br>B)

Q100: T-Bone company is contemplating investing in a

Q119: To calculate income from operations,total service department

Q125: What is the activity rate for production

Q153: A cost that will not be affected