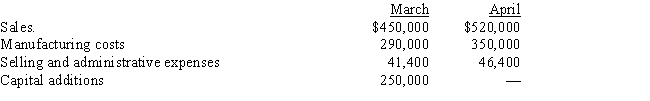

The treasurer of Calico Dreams Company has accumulated the following budget information for the first two months of the coming fiscal year:

The company expects to sell about 35% of its merchandise for cash.Of sales on account,80% are collected in full in the month of the sale,and the remainder in the month following the sale.One-fourth of the manufacturing costs are paid in the month in which they are incurred,and the other three-fourths in the following month.Depreciation,insurance,and property taxes represent $6,400 of the monthly selling and administrative expenses.Insurance is paid in February,and property taxes are paid yearly in September.A $40,000 installment on income taxes is to be paid in April.Of the remainder of the selling and administrative expenses,one-half are to be paid in the month in which they are incurred and the balance in the following month.Capital additions of $250,000 are paid in March.

The company expects to sell about 35% of its merchandise for cash.Of sales on account,80% are collected in full in the month of the sale,and the remainder in the month following the sale.One-fourth of the manufacturing costs are paid in the month in which they are incurred,and the other three-fourths in the following month.Depreciation,insurance,and property taxes represent $6,400 of the monthly selling and administrative expenses.Insurance is paid in February,and property taxes are paid yearly in September.A $40,000 installment on income taxes is to be paid in April.Of the remainder of the selling and administrative expenses,one-half are to be paid in the month in which they are incurred and the balance in the following month.Capital additions of $250,000 are paid in March.

Current assets as of March 1 are composed of cash of $45,000 and accounts receivable of $51,000.Current liabilities as of March 1 are accounts payable of $121,500 ($102,000 for materials purchases and $19,500 for operating expenses).Management desires to maintain a minimum cash balance of $25,000.

Prepare a monthly cash budget for March and April.

Definitions:

Each Other's Skills

The mutual competencies and abilities that individuals share or learn from one another in a collaborative environment.

Readability

The ease with which a reader can understand written text, often influenced by the text's complexity, sentence structure, and vocabulary.

Checklists and Illustrations

Tools used to ensure completeness in carrying out a task, and visual representations used to explain concepts or processes.

Training Materials

Are resources, manuals, modules, or programs designed to facilitate learning and development in a structured manner, often used in educational or professional settings.

Q27: In contribution margin analysis,the increase or decrease

Q44: If income from operations for a division

Q65: Standard costs are divided into which of

Q66: Which of the following expenses incurred by

Q107: A business operated at 100% of capacity

Q117: If at the end of the fiscal

Q121: Budgets need to be fair and attainable

Q165: A company's history indicates that 20% of

Q217: Spice Inc.'s unit selling price is $60,the

Q375: If fixed costs are $750,000 and variable