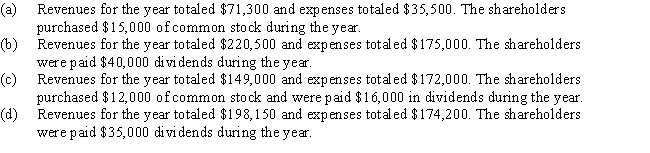

For each of the following,determine the amount of net income or net loss for the year.

Definitions:

Form 4070

A tax form used by employees in the United States to report tips received to their employer.

Tax Withholding

The portion of an employee's wages that is not included in their paycheck because it is sent directly to the federal, state, or local tax authorities as partial payment of income tax.

FICA Taxes

Taxes collected under the Federal Insurance Contributions Act to fund Social Security and Medicare, required deductions from workers' paychecks.

Schedule H

Schedule H is a tax form used by household employers to report wages paid to household employees, such as nannies or housekeepers, and calculate Social Security, Medicare, and FUTA taxes.

Q66: For an accounting period during which the

Q67: If Division Inc.expects to sell 200,000 units

Q71: Service firms can only have one activity

Q80: The dollars available from each unit of

Q84: Financial accounting provides information to all users,while

Q91: The absorption costing income statement does not

Q108: What is the overhead cost per unit

Q113: Costs that can be influenced by management

Q162: A business had a margin of safety

Q288: If the property tax rates are increased,this