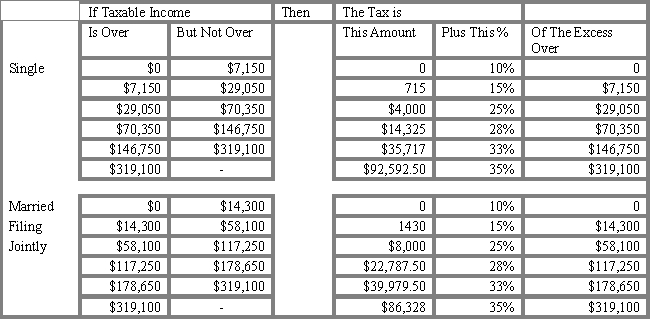

USE THE TAX TABLE PROVIDED BELOW FOR THE FOLLOWING PROBLEM(S)

-Refer to Exhibit 2.1. What is the marginal tax rate for a single individual with taxable income of $85,000?

Definitions:

Marginal Cost

The cost incurred by producing one additional unit of a product or service.

Indirect Cost

Expenses not directly tied to the production of goods or services, such as administration, rent, and utilities.

Manufacturing Overhead

This encompasses all the indirect costs associated with the manufacturing process, including utilities, depreciation, and salaries for non-direct labor.

Variable Cost

Costs that vary directly with the level of production or output, such as raw materials and direct labor expenses.

Q2: The risk premium is a function of

Q5: A trading rule which signals purchase of

Q7: Yields on money market funds are often

Q14: If this year is consistent with historical

Q50: Calculate the total after tax future value,

Q51: A project consists of six activities

Q62: If the nominal return on an investment

Q70: When choosing the most viable solution to

Q78: Drum buffers are:<br>A) A safety margin separating

Q87: The amount of work waiting to be