The following is a list of costs incurred by several business organizations:

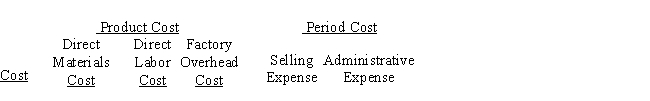

Classify each of the preceding costs as product costs or period costs.For those costs classified as product costs,indicate whether the product cost is a direct materials cost,direct labor cost,or factory overhead cost.For those costs classified as period costs,indicate whether the period cost is a selling expense or an administrative expense.Use the following tabular headings for preparing your answer.Place an X in the appropriate column.

Classify each of the preceding costs as product costs or period costs.For those costs classified as product costs,indicate whether the product cost is a direct materials cost,direct labor cost,or factory overhead cost.For those costs classified as period costs,indicate whether the period cost is a selling expense or an administrative expense.Use the following tabular headings for preparing your answer.Place an X in the appropriate column.

Definitions:

Inventory

The collective sum of all products and materials possessed by a company intended for either resale or production purposes, encompassing raw materials, unfinished products, and completed items.

Ending Inventory

The cumulative worth of all stock, encompassing raw materials, items in the process of being made, and completed products that a company possesses at the conclusion of a financial period.

Specific Identification

A method for inventory valuation where each item in inventory is identified and tracked individually.

Inventory Accounting

Inventory accounting is the process of valuing and tracking physical stock and includes methods such as FIFO (First In, First Out) and LIFO (Last In, First Out).

Q18: Activity-based costing can only be used to

Q24: The balance sheet data of Randolph Company

Q36: In a process costing system,costs flow into

Q134: Selling costs for the period<br>A)Product<br>B)Period

Q137: The Brass Works is in the process

Q138: The closer a company moves towards just-in-time

Q139: In a vertical analysis,the base for cost

Q149: A manufacturing company applies factory overhead based

Q155: The finished goods account is the controlling

Q171: Using the balance sheets for Kellman Company,if