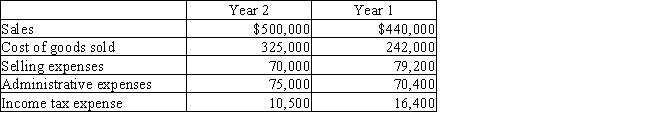

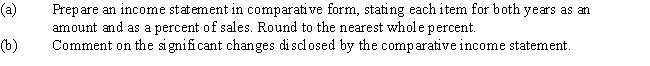

Revenue and expense data for Young Technologies Inc.are as follows:

Definitions:

Deferred Tax Asset

An accounting term for items that will reduce future tax liability due to deductible temporary differences and carryforwards.

Warranty Costs

Expenses associated with repairing or replacing products under warranty.

Installment Sales Method

An accounting technique used to recognize revenue from sales when payments are received in installments over a period of time.

Tax Purposes

The reasons or motivations behind decisions or actions taken to comply with tax laws and regulations.

Q5: Which of the following is the appropriate

Q31: The cash flows from operating activities are

Q68: Manufacturing costs for wood and steel used

Q71: Which of the following are the two

Q130: Zoe Corporation has the following information for

Q133: Managerial accounting reports must be prepared according

Q137: Which of the following items should be

Q151: Land costing $140,000 was sold for $173,000

Q180: Factory overhead is an example of a

Q189: Sabas Company has 40,000 shares of $100