On January 1,Year 1,a company had the following transactions:

- Issued 10,000 shares of $2.00 par common stock for $12.00 per share.

- Issued 3,000 shares of $50 par,6% cumulative preferred stock for $70 per share.

- Purchased 1,000 shares of previously issued common stock for $15.00 per share.

- No other shares of stock were issued or outstanding.

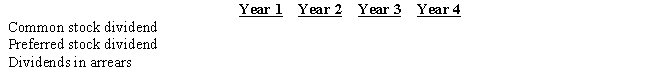

The company had the following dividend information available:

Year 1 - No dividend paid

Year 2 - Paid a $2,000 total dividend

Year 3 - Paid a $20,000 total dividend

Year 4 - Paid a $25,000 total dividend

Using the following format,fill in the correct values for each year:

Definitions:

Financial Institutions

Businesses that provide financial services, including banks, credit unions, and insurance companies.

Compounded Semi-Annually

Interest on an investment or loan calculated twice a year, adding each interest payment to the principal.

Principal

The original amount borrowed or invested.

Payments 13 to 24

Refers to the series of payments that are made from the thirteenth to the twenty-fourth installment in a sequence of payments.

Q45: The accounting for defined benefit plans is

Q60: In 20X9,a private not-for-profit hospital received a

Q65: Which of the following types of transactions

Q68: Based on the following data,what is the

Q94: On January 1,Vermont Corporation had 40,000 shares

Q145: Zeus Company reports the following for the

Q145: Using the following accounts and balances,prepare the

Q150: What is the asset turnover for Diane

Q151: Earnings per share<br>A) is the earnings available

Q174: Income statement information for Lucy Company is