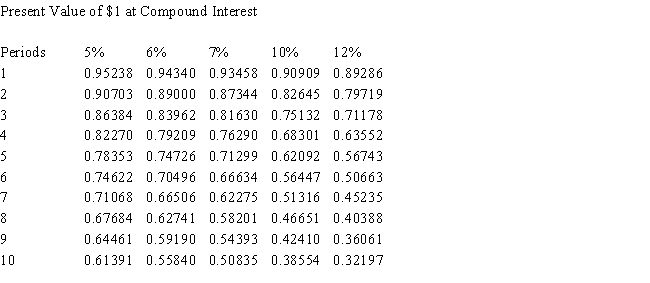

The present value of $5,000 to be received in 4 years at a market rate of interest of 6% compounded annually is $3,636.30.Use the following table,if needed.

Definitions:

Net Operating Income

A financial metric that calculates a company's profit after operating expenses are subtracted from operating revenues.

Required Rate

This is the minimum expected rate of return on an investment, dictating the least acceptable compensation for investing capital.

Salvage Value

A prediction of what an asset will be worth on the market at the close of its effective life.

Project Life

The duration from the initiation to the completion of a project, encompassing all stages of development, execution, and finalization.

Q10: Based on the information provided,in Golden Path's

Q18: _ have liens,or security interests,on specific assets.<br>A)Secured

Q24: Fixed assets and investments are reported in

Q84: Transaction: Billed patients for services rendered.<br>Effect on

Q87: Which is not a determinate in calculating

Q87: In accordance with FASB 116 (ASC 958),pledges,which

Q101: Cash flows from investing activities,as part of

Q104: Which of the following is not one

Q141: Calculate the total amount of interest expense

Q185: The amount of federal income taxes withheld