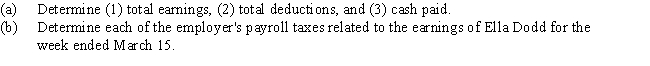

The following information is for employee Ella Dodd for the week ended March 15.

Total hours worked: 48

Rate: $15 per hour,with double time for all hours in excess of 40

Federal income tax withheld: $200

United Fund deduction: $50

Cumulative earnings prior to current week: $6,400

Tax rates:

Social security: 6% with no maximum earnings.

Medicare tax: 1.5% on all earnings.

State unemployment: 3.4% with no maximum earnings; on employer

Federal unemployment: 0.8% with no maximum earnings; on employer

Definitions:

Reduced Cell Elasticity

A decline in the ability of cells to return to their original shape after being stretched or compressed, often associated with aging or disease.

Medical Asepsis

Practices aimed at reducing the number and spread of pathogens in medical settings to prevent infection.

Urinary Catheterization

The insertion of a catheter into the bladder through the urethra to drain urine, often used for medical conditions that impair natural urination.

Parenteral Medications

Medicines administered bypassing the gastrointestinal tract, typically through injections.

Q8: The present value of an annuity is

Q13: Briefly explain the three classes of creditors

Q24: A 10% stock dividend will increase the

Q24: The interest expense recorded on an interest

Q32: Revenues from parking meters and parking fines

Q58: If $1,000,000 of 8% bonds are issued

Q84: On the first day of the fiscal

Q96: If 20,000 shares are authorized,15,000 shares are

Q117: Hadley Industries warrants its products for one

Q161: Townson Company had gross wages of $180,000