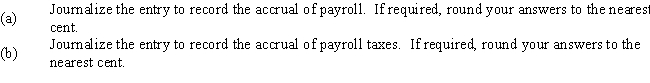

According to a summary of the payroll of Scotland Company,salaries for the period were $500,000.Federal income tax withheld was $98,000.Also,$15,000 was subject to state (4.2%)and federal (0.8%)unemployment taxes.All earnings are subject to social security tax of 6.0% and Medicare tax of 1.5%.

Definitions:

Q9: "Tombstone ad"<br>A) Provides preliminary information to investors

Q26: The Crafter Company has the following assets

Q26: Creditors may file which type of petition

Q43: Medicare taxes are paid by both the

Q46: When a partnership is formed,noncash assets contributed

Q48: The use of a separate payroll bank

Q90: "Basis for measuring investments in financial statements"

Q134: Given the following data,determine the times interest

Q149: When a borrower receives the face amount

Q173: The account used to record the difference