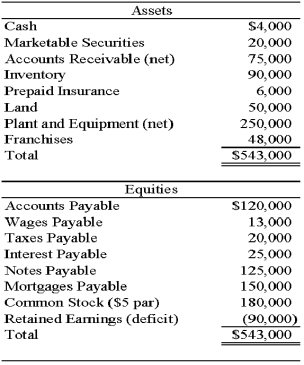

Wilbur Corporation is to be liquidated under Chapter 7 of the Bankruptcy Code.The balance sheet on December 31,20X8,is as follows:

The following additional information is available:

1.Marketable securities consist of 2,000 shares of Bristol Inc.common stock.The market value per share of the stock is $8.The stock was pledged against a $20,000,8 percent note payable that has accrued interest of $800.

2.Accounts receivable of $40,000 are collateral for a $35,000,10 percent note payable that has accrued interest of $3,500.

3.Inventory with a book value of $35,000 and a current value of $32,000 is pledged against accounts payable of $60,000.The appraised value of the remainder of the inventory is $50,000.

4.Only $1,000 will be recovered from prepaid insurance.

5.Land is appraised at $65,000 and plant and equipment at $160,000.

6.It is estimated that the franchises can be sold for $15,000.

7.All the wages payable qualify for priority.

8.The mortgages are on the land and on a building with a book value of $110,000 and an appraised value of $100,000.The accrued interest on the mortgages is $7,500.

9.Estimated legal and accounting fees for the liquidation are $10,000.

Required:

a.Prepare a statement of affairs as of December 31,20X8.

b.Compute the estimated percentage settlement to unsecured creditors.

Definitions:

Annual Demand

The total quantity of a product or service that consumers are willing and able to purchase over a year.

Safety Stock

Additional quantity of an item held in inventory to reduce the risk of stockouts caused by variability in supply or demand.

Stockouts

Occurrences when demand exceeds supply, resulting in an inability to fulfill customer orders or requirements immediately.

Inventory Carrying Costs

The total cost associated with holding inventory, including storage, insurance, depreciation, and opportunity costs.

Q10: When the old partners receive a bonus

Q24: Fixed assets and investments are reported in

Q24: Refer to the information provided above.Assume that

Q27: Refer to the information provided above.David invests

Q32: The information below is for the second

Q40: A company with 100,000 authorized shares of

Q50: "Reported as an expenditure of the fund

Q78: On January 1 of the current year,the

Q79: A private college received an offer from

Q183: Treasury stock that was purchased for $3,000